Building a strong credit score lays the foundation for a smooth business loan application process. Lenders use this score to determine both the interest rates you may qualify for and your overall reliability as a borrower. Maintaining a positive credit history reflects your commitment to responsible financial management, which can open doors to better loan options and greater flexibility in funding your business goals. By following clear and practical tips, you can take simple steps to improve your credit score and put yourself in a stronger position when it comes time to apply for financing.

Improving your credit score might seem overwhelming at first, but breaking down the process into manageable steps makes it easier to understand. Each section in this guide provides actionable tips designed with clear language so that anyone at a high school reading level can follow along. Let’s dive into the essential practices that will pave your way to better credit health.

Understanding the Basics of Credit Scores

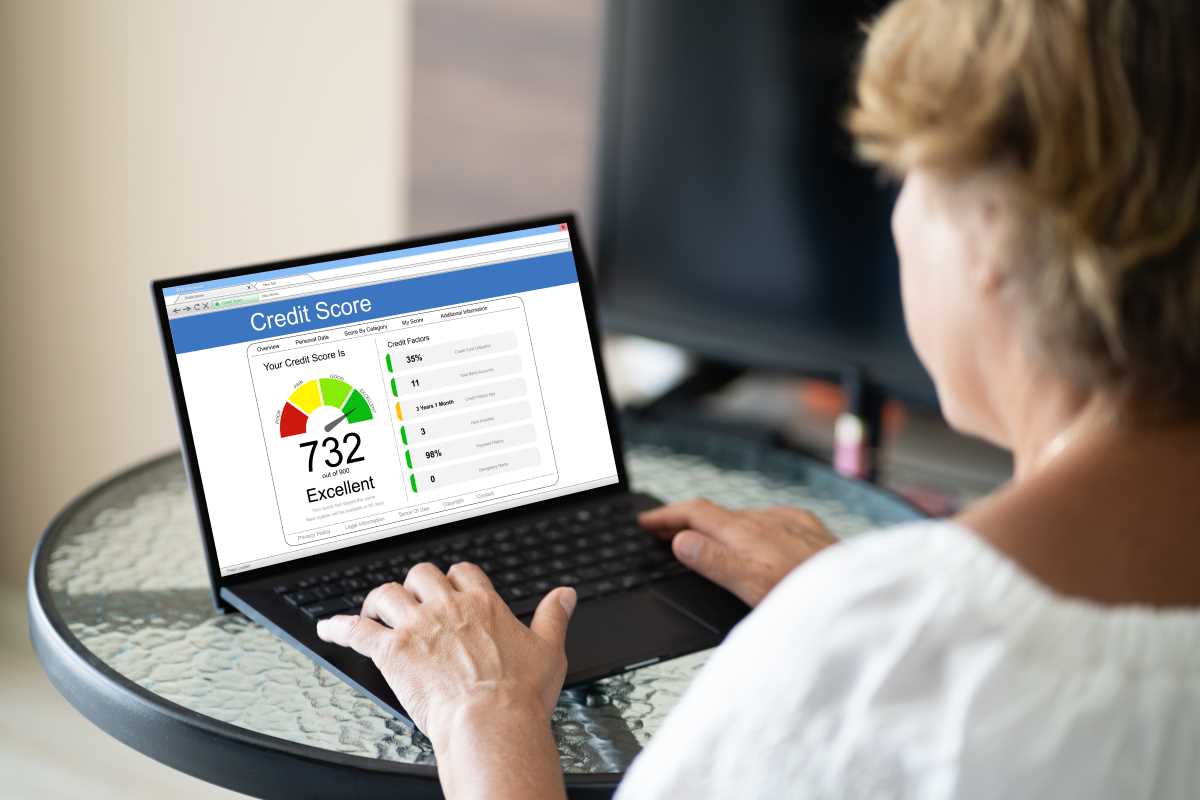

Your credit score is a numerical snapshot of your financial reliability. It shows lenders how likely you are to pay back money you borrow. A high score indicates that you’ve managed credit responsibly, while a lower score can signal potential risks. Knowing how these scores work helps you see why every action matters.

Credit scores are usually determined by factors like payment history, credit usage, length of credit history, types of credit, and recent inquiries. You can improve your score by paying attention to these elements and making smart financial decisions. This understanding lays the foundation for all the steps ahead.

Checking Your Credit Report and Identifying Errors

Regularly reviewing your credit report remains essential because it provides the details behind your credit score. Mistakes in your report, such as wrongly reported late payments or duplicated debts, can drag your score down. Taking the time to check for errors and dispute them can lead to noticeable improvements.

Follow these steps to effectively review your credit report:

- Request a free copy from the major reporting agencies.

- Go through every section carefully, noting any discrepancies.

- Gather supporting documentation for any errors you spot.

- Contact the agency to file a dispute and request corrections.

Reviewing your report not only clears up mistakes but also gives you insight into your overall financial habits.

Paying Bills On Time and Managing Debt

Paying your bills on time remains the backbone of a good credit score. Every missed due date can hinder your credit progress. Planning ahead and setting reminders can help you stay on track. When you stay consistent with payments, lenders see you as a reliable borrower.

Managing your debt responsibly also plays a crucial role. Here are some practical tips you can follow:

- Set up automatic payments for recurring bills.

- Create a budget to distribute your payments evenly throughout the month.

- Focus on paying off high-interest debts first.

- Talk to a financial advisor if you’re feeling overwhelmed by debt.

Keeping your debt under control will gradually reflect in your credit history and increase your score over time.

Limiting New Credit Applications and Managing Credit Mix

Every time you apply for new credit, an inquiry gets added to your report. Frequent inquiries can signal potential financial instability and lower your score. Be mindful of applying for too many credit lines at once, as this may result in additional negative marks on your record.

Understanding your credit mix remains important. A balanced mix of credit types such as loans, credit cards, and lines of credit demonstrates that you can manage different forms of debt. This variety can positively impact your credit score if you handle it carefully. Remember that maintaining a mix suited to your financial situation benefits you more than overloading on any one type of credit.

Using Proven Methods to Enhance Your Credit Score Ahead of a Business Loan Application

Before applying for a business loan, review and improve your credit habits. Focusing on specific actions reduces risks and positions you for better loan terms. For example, regularly monitoring your payment history and using credit responsibly builds a strong financial foundation.

Follow these five key methods to improve your credit profile:

- Make all your payments on time by setting clear reminders.

- Reduce your outstanding debt by paying more than the minimum due on your credit cards.

- Dispute any errors found in your credit report promptly and follow up until they’re corrected.

- Monitor your credit report regularly to stay on top of any changes.

- Avoid opening several new credit accounts in a short period to minimize the negative impact of hard inquiries.

Consistently applying these steps over time will gradually improve your credit standing and prepare you for a successful business loan application.

Build a stronger credit score by managing your credit responsibly. This approach can lead to better loan terms and improved financial prospects.